Tax Free Savings Account 2026

Tax Free Savings Account 2026

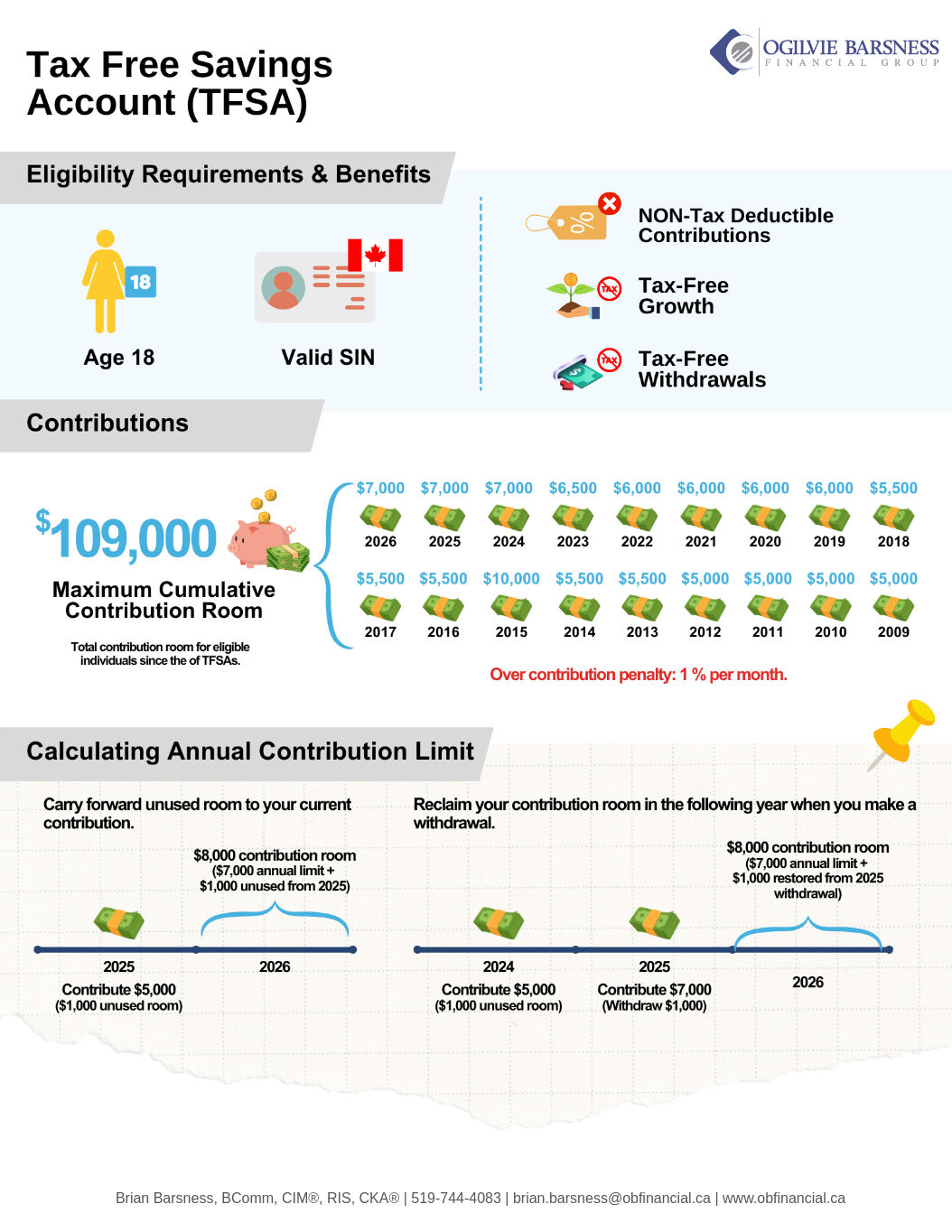

A Tax-Free Savings Account (TFSA) is a registered investment account available to Canadian residents. Its biggest advantage is simple: your investments can grow tax-free, and withdrawals are tax-free.

Because of its flexibility, the TFSA can play many roles — from short-term savings to long-term planning — depending on how it’s used and invested. Understanding the rules helps ensure you’re getting the most out of this account.

Eligibility Requirements

To open a TFSA, you must:

- Be a resident of Canada

- Have a valid Social Insurance Number (SIN)

- Be at least 18 years old

In provinces or territories where the legal age to enter a contract is 19, TFSA contribution room still begins accumulating at age 18, even though you may not be able to open the account until you reach the age of majority.

Key Benefits of a TFSA

Tax-free growth

Any income earned inside a TFSA is not taxed, including:

- Interest

- Dividends

- Capital gains

Tax-free withdrawals

You can generally withdraw money from your TFSA at any time, depending on the investments held. Withdrawals are not taxable and do not affect your income.

Withdrawals restore contribution room

Amounts withdrawn from your TFSA are added back to your contribution room at the beginning of the following calendar year, giving you ongoing flexibility.

TFSA Contribution Limit for 2026

The TFSA annual dollar limit has changed over time:

- 2009–2012: $5,000

- 2013–2014: $5,500

- 2015: $10,000

- 2016–2018: $5,500

- 2019–2022: $6,000

- 2023: $6,500

- 2024–2026: $7,000

If you have been eligible to contribute since 2009 and have never contributed, your total cumulative TFSA contribution room as of 2026 is $109,000.

Your personal TFSA contribution room is generally made up of:

- The current year’s TFSA limit

- Any unused TFSA room from prior years

- Withdrawals made in the previous year

Calculating Annual Contribution Room

Example #1: Carrying forward unused room

In 2025, the TFSA limit is $7,000.

You contribute $5,000, leaving $1,000 unused.

In 2026, your available contribution room becomes:

- $7,000 (2026 annual limit) + $1,000 (unused from 2025) = $8,000 total contribution room

Unused TFSA room continues to carry forward indefinitely.

Example #2: Withdrawals create new room the following year

In 2025, you contribute $7,000 and later withdraw $1,000.

In 2026, your contribution room becomes:

- $7,000 (2026 limit) + $1,000 (withdrawn in 2025) = $8,000 total room

Withdrawals do not permanently reduce your TFSA — they simply delay when that room becomes available again.

Over-Contributions: What to Watch For

If you exceed your available TFSA contribution room at any time during the year, a penalty applies:

- 1% per month on the highest excess amount

- Charged for each month the excess remains in the account

This most commonly happens when someone withdraws funds and re-contributes them in the same year without sufficient available room.

Eligible Investments

Most investments permitted in an RRSP are also allowed in a TFSA, including:

- Cash and savings

- Guaranteed Investment Certificates (GICs)

- Mutual funds and segregated funds

- Exchange-traded funds (ETFs) and publicly traded stocks

- Bonds

The right investment mix depends on your goals, timeline, and comfort with risk.

TFSA Withdrawals and Re-Contributions

You can generally withdraw any amount from your TFSA at any time. However, if you plan to re-contribute those funds in the same calendar year, you must already have enough unused TFSA room available.

For example, if you withdraw $1,000 in 2026 and re-contribute it later in 2026 without available room, the re-contribution may be treated as an over-contribution and subject to penalty tax.

Beneficiary vs. Successor Holder: Why This Matters for Spouses

When setting up a TFSA, you can name either a beneficiary or, if applicable, a successor holder. While the terms sound similar, the outcome can be very different — especially for spouses and common-law partners.

Successor Holder (Spouse or Common-Law Partner Only)

A successor holder can only be a spouse or common-law partner. When a spouse is named as successor holder:

- The TFSA continues in their name after death

- The account remains tax-free

- No TFSA contribution room is used by the surviving spouse

- The account does not need to be collapsed or transferred

This is often the most seamless and tax-efficient option for couples, as it allows the TFSA to continue uninterrupted.

Beneficiary (Anyone You Choose)

A beneficiary can be anyone, including a spouse, child, or other family member. When a TFSA beneficiary is named:

- The value of the TFSA at the date of death is paid out tax-free

- The TFSA does not continue as a TFSA in the beneficiary’s name

- Any growth after death may be taxable

- If the beneficiary is a spouse, the inherited amount does not automatically retain TFSA status

A spouse beneficiary may be able to contribute the inherited amount to their own TFSA only if they have available contribution room.

Why the Distinction Is Important

For married or common-law couples, naming a successor holder instead of a beneficiary can:

- Preserve the TFSA’s tax-free status

- Avoid using up the surviving spouse’s TFSA contribution room

- Reduce administrative delays and paperwork

- Simplify estate settlement

This designation must be set up correctly and reviewed periodically, as rules can vary depending on the account provider and province.

Using a TFSA Effectively in 2026

A TFSA can support many goals — emergency savings, major purchases, retirement flexibility, or long-term investing. The key is ensuring it works alongside your other accounts, such as RRSPs and FHSAs, rather than in isolation.

If you’re unsure how much to contribute, how to invest, or how a TFSA fits into your overall strategy, reviewing your approach regularly can help keep your plan on track for 2026 and beyond.

Sources:

- Canada Revenue Agency. Tax-Free Savings Account (TFSA). Government of Canada, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account.html